Allocate Overhead Cost Formula

Allocations of costs or revenues to particular periods within a project may cause severe changes in particular indicators but have. Therefore this overhead cost is allocated to the lowest level in the organization.

Traditional Methods Of Allocating Manufacturing Overhead Accountingcoach

101 Cost and profit - General information 2021-03-19Contracting officers should refer to the Practitioners Guide for Procurement Pricing for more information and guidance on contract pricing.

. If you require a visual flow of the cost between the cost objects you can use the cost roll-up. Cost pool Total activity measure Overhead allocation per unit. In other words the cost objects at the lowest level bear the cost.

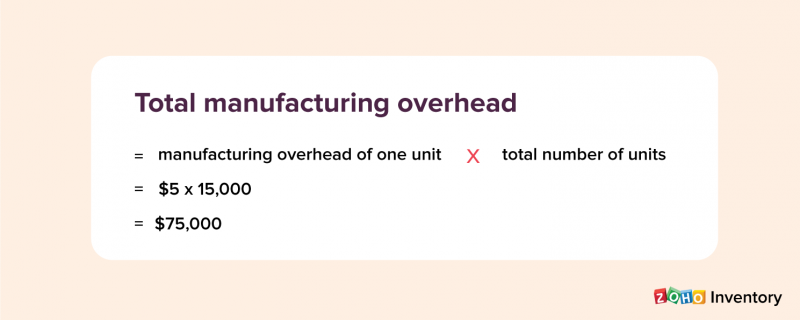

The journal entry for this formula is as follows. The estimated overhead costs Overhead Costs Overhead cost are those cost that is not related directly on the production activity and are therefore considered as indirect costs that have to be paid even if there is no production. Heres how that would look if Company A had 700 labor hours per month.

Thus the overhead allocation formula is. You can allocate overhead costs by any reasonable measure as long as it is consistently applied across reporting periods. Absorption costing is linking all production costs to the cost unit to calculate a full cost per unit of inventories.

Another common example is the use of equipment depreciation schedules to allocate equipment purchase costs. The formula is as follows. A company may allocate its indirect costs in order to determine the entire cost of a cost object on a full absorption basis.

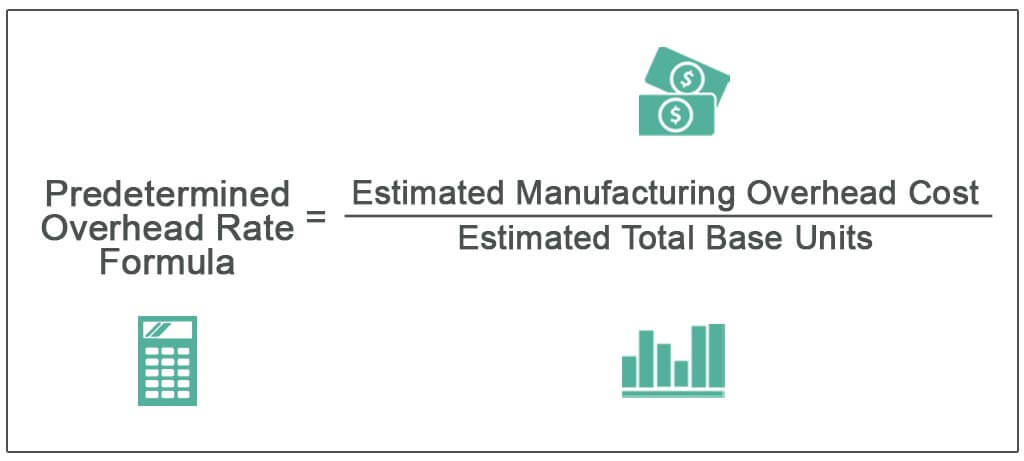

Total overhead total labor hours overhead allocation rate. Formula to Calculate Predetermined Overhead Rate. Definition Formula Calculation and.

Overhead is an accounting term that refers to all ongoing business expenses not including or related to direct labor direct materials or third-party expenses that are billed directly to. To allocate costs begin by deciding which cost objects you want to connect with specific costs. It develops a common foundation in accounting and business and provides various courses covering both fundamental and specialized accounting topics to meet individual career goals.

Read more shall be used. The basic formula for forecasting cost from unit costs is. A notable exception is direct labor costs which usually remain constant.

The basic calculation for ending inventory is the beginning. An indirect cost is a cost that is not associated with a single activity. This degree focuses on preparation for careers in various accounting professions.

This means that for every hour spent consulting Company A needs to allocate 17142 in overhead. Labor and allocated overhead. Cost of goods sold COGS is the.

This article shows how a primary cost element 10001 Electricity flows through the cost objects. Allocation bases are mostly used to assign overhead costs to inventory that is produced. 122 where C f is the forecast total cost W is the total units of work.

Smartphone hardware for example is a direct variable cost because its production depends on the number of units ordered. To decide which cost objects to use in your calculations consider using available data to determine any missing. Common bases of allocation are direct labor hours charged against a product or the amount of machine hours used.

An allocation base is the basis on which Cost accounting allocates overhead costs. Its predetermined overhead rate was based on a cost formula that estimated 102000 of manufacturing overhead for an estimated allocation base of 85000 direct material dollars to be used in production. The amount incurred as direct labor cost depends on how efficiently the workers produced finished items.

How to Calculate Direct Labor Cost per Unit. For example an IT department allocates. For example if the ratio of overhead costs to direct labor hours is 35 per hour the company would allocate 35 of overhead costs per direct labor hour to the production output.

For small widgets the allocation equals. Using the formula the materials price variance 19 17 x 20500 41000. When the goods are bought or produced the costs associated with such goods are capitalized as part of.

The company has provided the following data for the just completed year. Cost of Ending Inventory. Identify your chosen cost object.

Finally allocate the overhead by multiplying the overhead rate by the number of labor hours required. Examples of indirect costs are facility rent utilities and office supplies. The cost of ending inventory is the value of what is leftover in stock and available for sale at the end of a period.

It is sometimes called the full costing method because it includes all costs to get. Examples include specific products marketing campaigns or business departments and divisions. Read more are the costs that.

Examples include rent payable utilities payable insurance payable salaries payable to office staff office supplies etc. Full absorption refers to the assignment of all possible costs to a. This costing method treats all production costs as costs of the product regardless of fixed cost or variance cost.

A Predetermined Overhead rate Predetermined Overhead Rate Predetermined overhead rate is the distribution of expected manufacturing cost to the presumed units of machine-hours direct labour hours direct material etc for acquiring the per-unit expense before every accounting period. An allocation base can be a quantity such as machine hours that are used kilowatt hours kWh that are consumed or square footage that is occupied. Many businesses sell goods that they have bought or produced.

The costs of those goods which are not yet sold are deferred as costs of inventory until the inventory is sold or written down in value. A Formula for Equipment Cost Recovery The more equipment you use the more accurate equipment cost recovery techniques must be. When a contract must be awarded on a non-competitive basis or when following a competitive process price negotiations with the successful bidder are required.

Indirect Cost Calculation And Process About Ala

Predetermined Overhead Rate Formula How To Calculate

No comments for "Allocate Overhead Cost Formula"

Post a Comment